The Senate Finance Committee hears tax code amendments proposing to drop the corporate income tax rate by 2 percent over the next three years. (Photo: Dave Fisher)

This week, both the House and Senate finance committees considered legislation that would reduce the corporate income tax from 9 percent to 7 percent over the next three years.

The move, as always, is touted as a way to make Rhode Island?s business climate more competitive with our neighboring states?. While Rhode Island?s corporate tax rate is the highest in New England, as I posted yesterday, the real-world ramifications of a 2 percent state tax reduction means little to most of our businesses, due to the fact that the majority of the tax burden on Rhode Island?s businesses are borne of local property, sewer, and tangible asset taxes.

The vast majority of our businesses, y?know, the small ones that legislators tout as the ?lifeblood of Rhode Island?s economy? report income of less than $249,999 on their tax returns. Even at the top of that tier, a business that reports earnings of $249,999 pays $22,499 in taxes to the state at 9 percent. At a rate of 7 percent, that same business would pay 17,499; a net gain of $5,000 which could easily be eaten up by those local taxes, especially if that business made capital improvements to its structure or purchased new equipment.

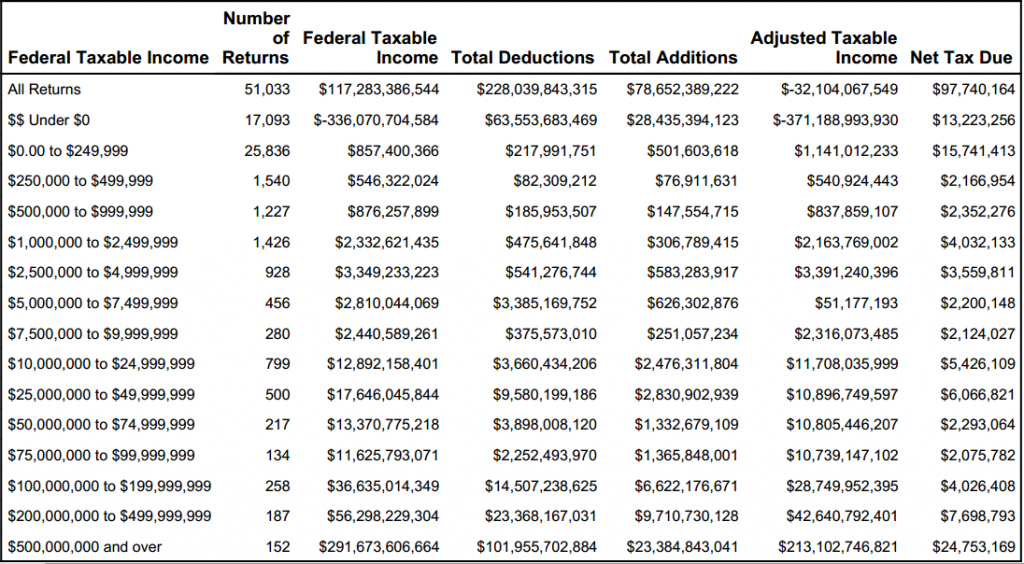

Check out this chart of the combined corporate income and taxes collected by the state for FY 2010 from the R.I. Division of Revenue.

As you can see, the 42,929 businesses that reported a loss/or $249,999 or under in income paid just under $29 million, even though the combined adjusted income of these entities was actually a loss of ?over $370 billion.

At the other end of the spectrum, the 152 businesses that reported income of $500 million or over, whose adjusted taxable income was just over $212 billion ? a 580 billion dollar increase from the low end of the tier ? paid just under $25 million, or $4 million less than the nearly 43,000 businesses who posted either a loss or income of $249,999 or less.

A policy brief issued by the Economic Progress Institute stated,

?With a price tag of almost $90 million over five years, the proposed corporate income tax reduction could backfire if public services that businesses rely on are cut as a result of revenue losses. Furthermore, the proposal will do nothing to help the majority of local businesses that do not pay the corporate income tax. Finally, research suggests that corporate tax cuts do little to stimulate economic growth.?

Once again, our small businesses get hosed by the tax code. It seems that even when it comes to corporate ?people?, the 1 percent ride the backs of the 99 percent. And to top it all off, many of these 152 top-tier businesses get cushy tax breaks on property and tangible assets from the cities and towns that they call home.

Tax equity anyone?

VN:R_U [1.9.20_1166]

Rating: 0.0/10 (0 votes cast)

- Pharmaceutical Company Asks EDC for Tax Break

- VIDEO: Three Perspectives on Income Tax Equity Bill

- Tax Equity Still A Question for Impending Budget Bill

- Are Tides Turning Toward Tax Equity Legislation?

- Proposal to tax the richest Rhode Islanders

Source: http://www.rifuture.org/do-ri-corporations-really-need-a-tax-break.html

the international preppers geraldo obama trayvon martin pietrus cheney tori spelling

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন